International and Monetary Economics (MIME) Abschluss: Master

MIME is a joint, specialized Master’s degree offered by the Universities of Basel and Bern.

Im Überblick

- Art

- Studiengang

- Abschluss

- Master

- Studienstart

- Herbst-, Frühjahrsemester

- Struktur

- 1 Studiengang

- Regelstudienzeit

- 3 Semester

- Credits

- 90

- Sprache

- Englisch

- Zuständige Fakultät

- Wirtschaftswissenschaftliche Fakultät

Zugangsvoraussetzung

Zulassung für Erstsemester

Termine und Fristen

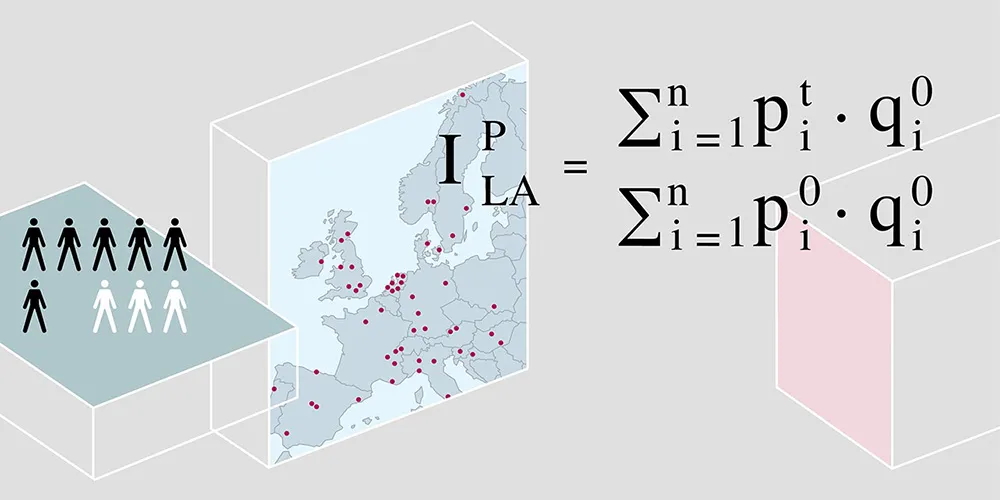

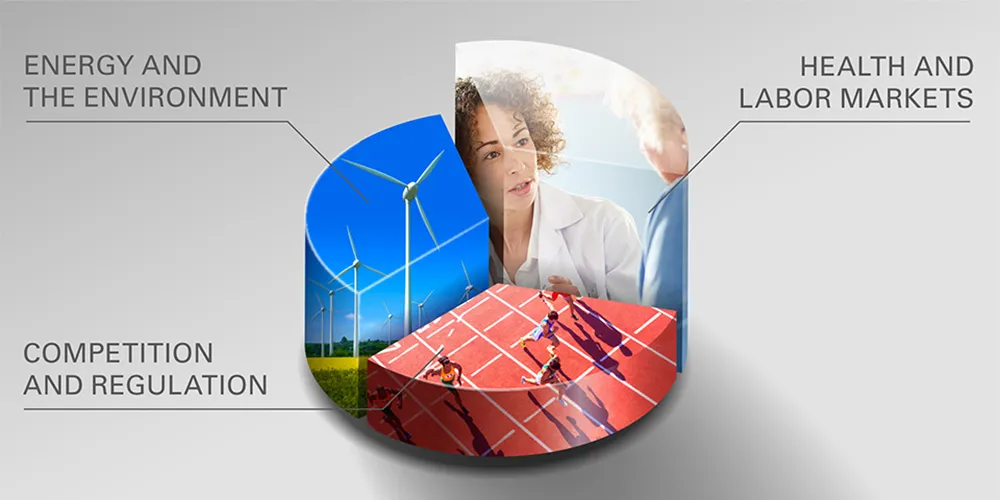

A comprehensive understanding of monetary policy, financial markets and their regulatory environment constitutes the core of this master’s program, particularly designed for students with a strong background in quantitative economics. In the context of growing economic globalization, international issues regarding monetary policy and macroeconomics in general are becoming increasingly important. This is particularly the case for small open economies such as Switzerland, a substantial portion of whose income is derived from the export of goods and services as well as from capital earnings. It also applies to the growing integrated market of the European Union, to many emerging economies as well as to large mature economies (such as the U.S.) that are more affected by international developments today than they were in the past. As domestic aspects become relatively less important, it is essential to the economic wellbeing of many countries that competent specialists are trained to focus on aspects of international economics. Especially the recent financial crisis and its effects on economies throughout the world demonstrate how important an efficiently functioning monetary sector is for today’s global economy.

Weiterführende Links und Downloads

Research Findings and Scientific Developments

Are you interested in current scientific developments and research findings in this field? On the research websites, you will find numerous publications by researchers from the University of Basel. This resource offers valuable insights and helps you get to know a subject area better–both as an orientation aid and as an accompanying source of information during your studies.

Discover publications and research areas now

Das richtige Studium gefunden?

Diese Studienangebote könnten Sie ebenfalls interessieren:

Melde dich jetzt für die Schnupper Winter School der Universität Basel an.

Interessierst du dich für ein Studium an der Universität Basel?

Vom 16. bis 20. Februar 2026 finden Workshops für Gymnasiasten und Gymnasiastinnen statt.

Zum Programm der Schnupper Winter School 2026.